From Paycheck Pressure to Peak Performance: Supporting Employees Through Financial Stress

From Paycheck Pressure to Peak Performance: Supporting Employees Through Financial Stress

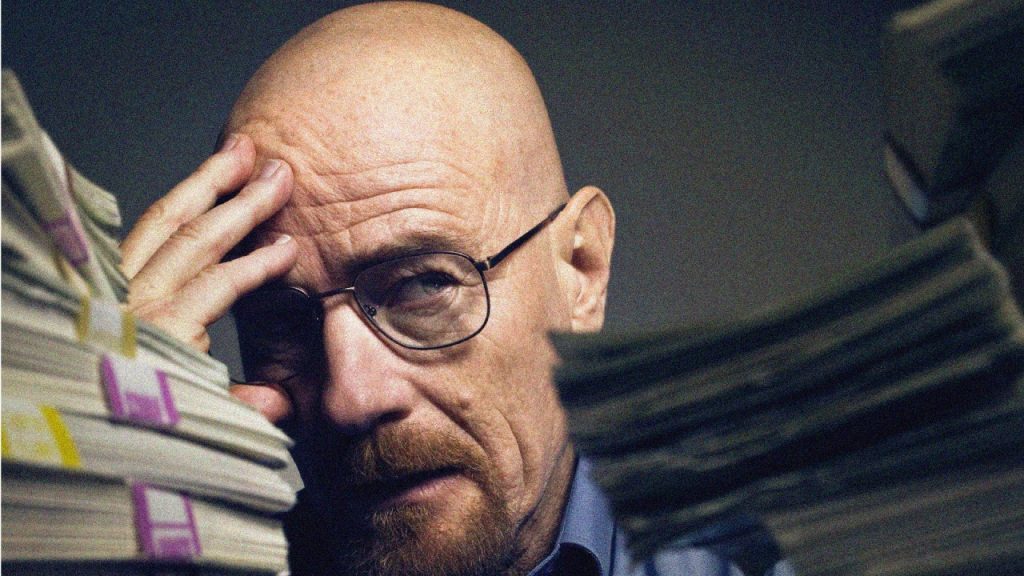

Work needs to be done—and bills need to be paid. But what happens when employees are constantly worried about money? The result is often stress, distraction, and declining productivity.

A recent report from wage access provider Zayzoon revealed a startling insight: 52% of employees have no savings for unexpected expenses. They’re living paycheck to paycheck, and it’s taking a toll—not just on them, but on their performance at work.

So, what can employers do about it?

Financial Stress is a Hidden Productivity Killer

When money is tight, employees bring that stress with them to work. Over 40% of employees in the study admitted that financial concerns reduce their ability to focus during work hours. And 65% of employers say they’ve seen this impact firsthand.

The financial strain is real, and it’s not just about salary. Rising living costs and lack of savings create constant anxiety. Many employees are now looking to their employers for more than just a paycheck—they want real financial wellness support.

What employees are asking for:

- Access to financial literacy programs and budgeting tools

- On-demand pay options

- Employer-organized retirement plans and contribution matching

These benefits don’t just ease financial pressure—they help employees feel valued, supported, and more focused at work.

Aligning Support with Every Stage of the Employee Journey

Financial wellbeing isn’t one-size-fits-all. Different stages of an employee’s journey come with different challenges—and smart employers adapt accordingly.

Here’s how employers can show up at every step:

1. Onboarding & Early Career

Set the right tone with competitive starting salaries, early access to benefits, and clear onboarding processes. When employees feel secure from day one, they perform better.

2. Development & Growth

Help employees upskill with training and mentorship, and reward them with raises or bonuses as they grow. Recognizing ambition and effort keeps engagement high.

3. Mid-Career

Mid-career professionals often juggle major financial responsibilities. Support them with performance-based incentives, home insurance benefits, and long-term savings plans.

4. Navigating Life Changes

From becoming a parent to managing health issues, life happens. Flexibility, wellness programs, childcare subsidies, and healthcare support go a long way in boosting loyalty and reducing burnout.

5. Late Career & Retirement

Offer phased retirement plans, knowledge-sharing opportunities, and robust financial planning resources. These not only honor years of service but ensure smooth transitions and retain institutional wisdom.

6. Post-Retirement

Stay connected through alumni programs or consulting opportunities. Providing post-retirement engagement helps retirees feel valued while benefiting the organization through continued expertise.

🚀 Why It Matters for Businesses

When companies invest in the financial wellness of their workforce, they’re investing in engagement, productivity, and retention. It’s not just a perk—it’s a performance strategy.

At Elite Career Centre, We Believe in the Power of People

As a corporate training and development provider, we specialize in empowering employees with soft skills, financial literacy, and career growth tools that align with every stage of their journey.

✅ From onboarding workshops to leadership development ✅ From financial wellness programs to team-building retreats ✅ We help organizations build resilient, productive, and future-ready teams.

Let’s work together to unlock your team’s full potential.